Exactly How a Forex Trading Forum Can Assist You Navigate the marketplaces Efficiently

Exactly How a Forex Trading Forum Can Assist You Navigate the marketplaces Efficiently

Blog Article

The Value of Money Exchange in Global Profession and Business

Currency exchange serves as the foundation of worldwide trade and business, making it possible for smooth deals in between diverse economies. As variations in exchange rates can present significant dangers, reliable currency threat administration ends up being vital for maintaining an affordable side.

Function of Currency Exchange

Money exchange plays an important role in facilitating international trade by making it possible for purchases in between events operating in various currencies. As businesses increasingly take part in international markets, the demand for reliable currency exchange systems becomes extremely important. Currency exchange rate, which vary based on different economic signs, figure out the worth of one currency relative to an additional, affecting profession dynamics significantly.

In addition, money exchange minimizes dangers connected with international purchases by supplying hedging alternatives that secure versus adverse currency motions. This financial tool allows services to maintain their prices and incomes, better advertising worldwide trade. In recap, the duty of money exchange is main to the performance of international business, providing the important framework for cross-border deals and sustaining economic growth worldwide.

Effect On Pricing Techniques

The systems of money exchange considerably affect rates techniques for companies engaged in global profession. When a domestic currency strengthens versus international currencies, imported items may come to be less pricey, allowing companies to reduced costs or boost market competitiveness.

Business typically embrace pricing techniques such as localization, where costs are customized to each market based on money fluctuations and neighborhood financial factors. Additionally, dynamic prices versions might be utilized to react to real-time money activities, guaranteeing that businesses stay nimble and competitive.

Impact on Profit Margins

Rising and fall currency exchange rate can exceptionally influence earnings margins for companies engaged in global profession. When a company exports products, the income created frequents a foreign money. If the worth of that currency decreases loved one to the firm's home currency, the revenues understood from sales can reduce dramatically. On the other hand, if the foreign money values, profit margins can raise, improving the general monetary performance of business.

Additionally, organizations importing products face similar threats. A decrease in the worth of their home money can result in higher prices for foreign products, ultimately pressing revenue margins. This circumstance necessitates effective currency risk management strategies, such as hedging, to reduce potential losses.

Moreover, the effect of currency exchange rate changes is not restricted to guide deals. It can also affect prices techniques, affordable positioning, and overall market dynamics. Business need to remain watchful in keeping an eye on currency image source trends and changing their financial approaches appropriately to secure their profits. In recap, understanding and taking care of the influence of money exchange on revenue margins is essential for businesses aiming to keep profitability in the complicated landscape of global profession.

Market Accessibility and Competition

Browsing the complexities of global profession calls for services not just to take care of earnings margins yet likewise to make sure reliable market access and enhance competitiveness. Money exchange plays an essential role in this context, as it straight affects a like it company's capacity to go into new markets and compete on an international scale.

A beneficial exchange price can decrease the price of exporting items, making products much more attractive to international customers. On the other hand, an unfavorable price can inflate prices, impeding market infiltration. Firms have to strategically handle currency fluctuations to maximize rates techniques and continue to be affordable against neighborhood and worldwide players.

In addition, companies that successfully make use of currency exchange can develop chances for diversification in markets with positive problems. By establishing a solid presence in numerous currencies, organizations can reduce dangers connected with reliance on a solitary market. forex trading forum. recommended you read This multi-currency technique not only enhances competition but likewise promotes strength when faced with economic changes

Risks and Obstacles in Exchange

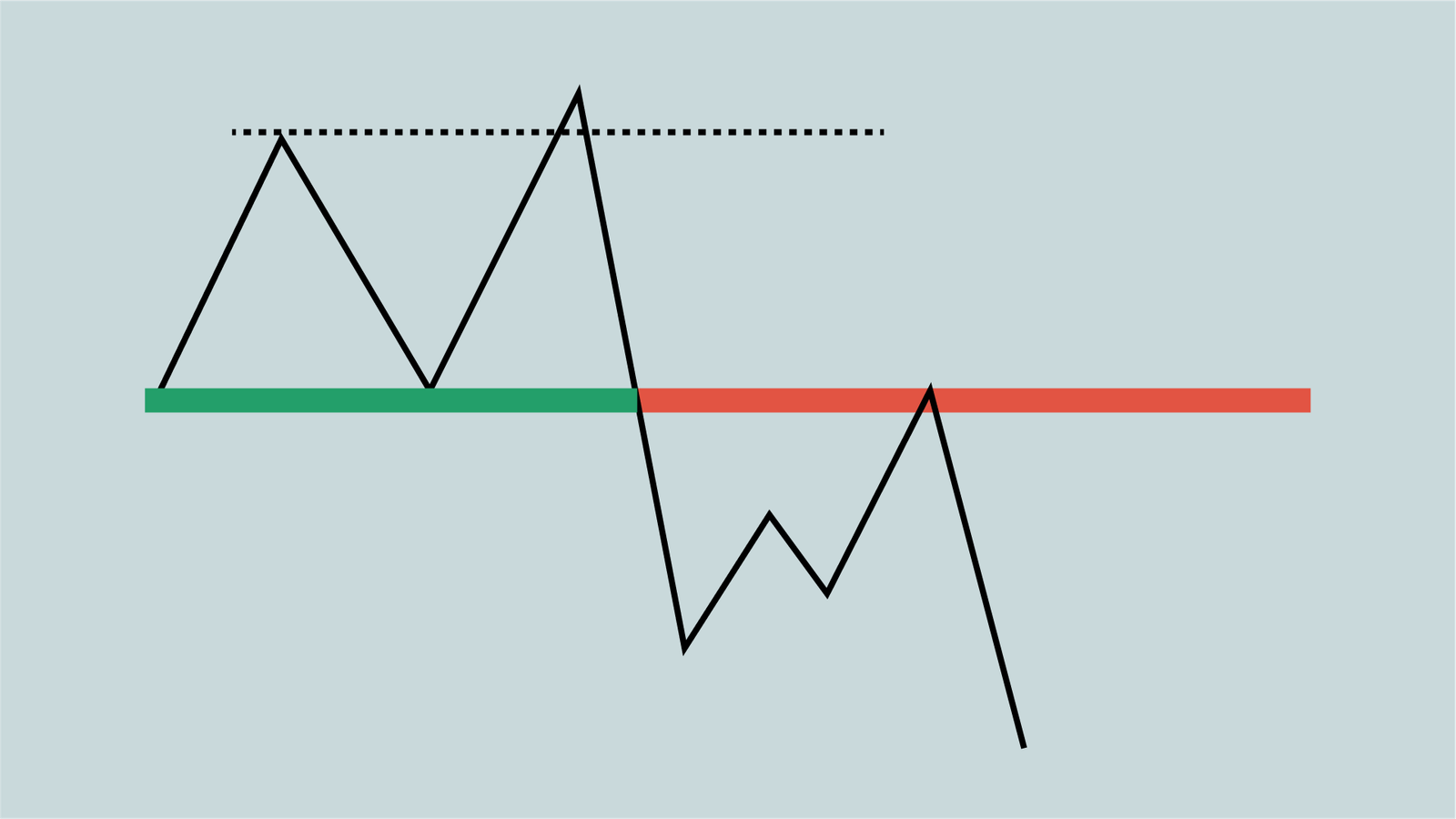

In the realm of worldwide profession, companies encounter significant dangers and obstacles related to money exchange that can impact their financial stability and functional methods. Among the main risks is exchange price volatility, which can lead to unexpected losses when converting money. Changes in exchange rates can influence earnings margins, specifically for companies taken part in import and export tasks.

In addition, geopolitical factors, such as political instability and regulative changes, can worsen money threats. These elements may cause abrupt changes in currency values, making complex monetary forecasting and planning. Businesses need to browse the complexities of international exchange markets, which can be affected by macroeconomic signs and market view.

Verdict

To conclude, currency exchange acts as a foundation of global trade and business, promoting transactions and boosting market liquidity. Its influence on pricing approaches and revenue margins underscores the requirement for efficient currency risk administration. Additionally, the capacity to navigate market accessibility and competition is extremely important for organizations operating globally. Despite inherent dangers and obstacles connected with rising and fall currency exchange rate, the relevance of currency exchange in fostering financial development and durability continues to be indisputable.

Report this page